In 2023, the global fashion industry will need to weather inflation while finding opportunities in shifting consumer patterns, channel and digital marketing strategies, and manufacturing approaches.

‘Fashion forecasts’ a McKinsey analysis

The seventh annual State of Fashion report by The Business of Fashion and McKinsey & Company reveals the industry is heading for a global slowdown in 2023 as macroeconomic tensions and slumping consumer confidence chip away at 2022′s gains.

After experiencing 18 months of robust growth (early 2021 through mid-2022), the fashion industry is again facing a challenging climate. Hyperinflation and depressed customer sentiments have already resulted in declining growth rates in the second half of 2022. Industry experts predict that the slowdown is likely to continue through 2023. However many industry players are in a stronger position than they were a year ago. The fashion industry delivered a 21 percent increase in revenues in 2020–21, and EBITA margins doubled by 6 percentage points to 12.3 percent. Looking forward, the predominant anticipations are that the luxury sector will outperform the rest of the industry, as wealthy shoppers continue to travel and spend, and thus remain more insulated from the effects of hyperinflation. Based on McKinsey’s analysis of fashion forecasts, the luxury sector is expected to grow between 5 and 10 percent in 2023, driven by strong momentum in China (projected to grow between 9 and 14 percent) and in the United States (projected to grow between 5 and 10 percent). Europe, on the other hand, is under high pressure from currency rates and a growing energy crisis, which are likely to result in modest sales growth for the luxury sector (projected to grow between 3 and 8 percent).

As per experts the Fashion Industry presents a difficult outlook ahead, as fashion companies face challenges and revise forecasts downward after an exceptionally strong 2021, per McKinsey analysis of global data in the fashion industry. Inflation and geopolitical concerns dominate the agenda for 2023, negatively affecting both consumer demand and brands’ operating costs. Consumers are adjusting their behaviors, as many trade down to cheaper or discounted items to reduce their spending, though the luxury sector will remain strong, with affluent consumers less heavily affected by inflation.

Fashion companies that can adapt to the increasing complexity by updating their operating models and adjusting their strategies for supply chain, sales channels, and digital marketing will be best placed to weather the upcoming storm. Today it is extremely vital for them to analyze the emerging consumer trends, and to lean towards them while taking executive decisions.

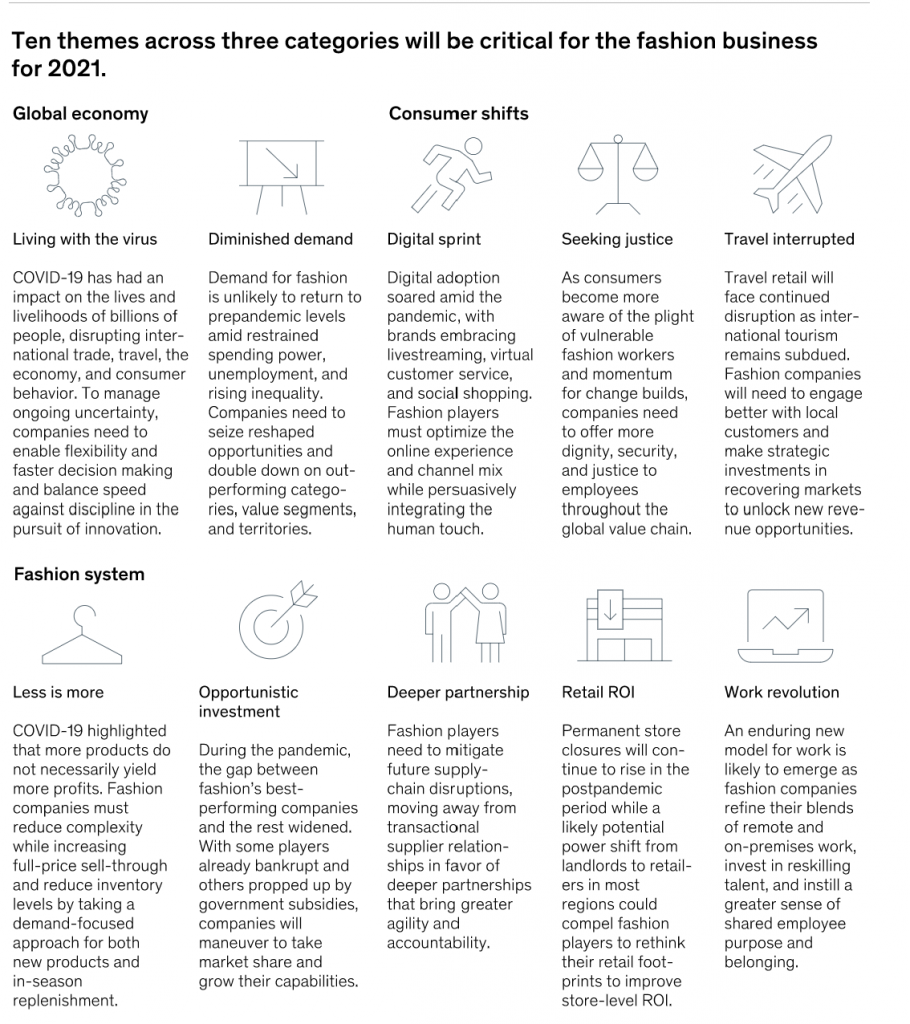

Ten themes for 2023

We, at Vision College of Management are working to build the prediction models for the State of Fashion 2023. The State of Fashion 2023 Report predicts 10 themes for 2023, which may be categorized into Global economy, consumer shifts, and fashion system. We have provided a brief outline of each below:

- Global economy

- Global fragility: Fashion brands will need careful planning to navigate the many uncertainties and recessionary risks amidst the highest inflation in a generation, rising geopolitical tensions, climate crises, and sinking consumer confidence that lie ahead in 2023.

- Regional realities: Brands need to be clear about where to invest around the world with rising geopolitical uncertainty and uneven economic recoveries related to the COVID-19 pandemic. They need to reevaluate regional growth priorities and hone their strategies so that they are more tailored to the geographies in which they operate.

- Consumer shifts

- Two-track spending: Consumers may be affected differently by the potential economic turbulence in 2023. Depending on factors such as disposable income level, some will postpone or curtail discretionary purchases; others will seek out bargains, increasing the demand for resale, rental, and off-price products.

- Fluid fashion: Gender-fluid fashion is gaining greater traction amid changing consumer attitudes toward gender identity and expression. For many brands and retailers, the blurring of the lines between men’s wear and women’s wear will require rethinking their product design, marketing, and in-store and digital shopping experiences.

- Formal wear reinvented: Formal attire is taking on new definitions as shoppers rethink how they dress for work, weddings, and other occasions.

- Fashion system

- Direct-to-consumer reckoning: To grow, brands will likely need to diversify their channel mix, including wholesale and third-party marketplaces, alongside direct-to-consumer models.

- Tackling greenwashing: As the industry continues to grapple with its damaging environmental and social impact, consumers, regulators, and other stakeholders may increasingly scrutinize how brands communicate about their sustainability credentials.

- Future-proofing manufacturing: Textile manufacturers can create new supply chain models based around vertical integration, nearshoring, and small-batch production, enabled by enhanced digitization.

- Digital marketing reloaded: Brands will need to embrace creative campaigns and new channels, such as retail media networks and the metaverse, to achieve greater ROI on marketing spend and to gather valuable first-party data that can be leveraged to deepen customer relationships.

- Organization overhaul: Fashion executives need a new vision for what the organization of the future will require, focusing on attracting and retaining top talent to execute on priorities such as sustainability and digital acceleration.

Looking ahead

Fashion companies will need to rethink their operations. Many will update their organizational structures, introducing new roles or elevating existing ones to target key growth opportunities and respond more effectively to risk. Brands may also choose to see the next year as a time to team up with manufacturing partners to sharpen their supply chain strategies. This may involve nearshoring to better respond to fast-shifting consumer demand or leaning more heavily on data analytics and technology to manage inventory efficiently.

Distribution channel mixes are also ripe for reassessment. As e-commerce growth normalizes after its pandemic boom, the sheen has started to wear off the direct-to-consumer digital model that propelled many brands over the past decade. As lockdown restrictions lifted, shoppers have made it clear that although they still value online channels — particularly within luxury, where online DTC and third-party platforms will continue to drive growth — shoppers also want brick-and-mortar experiences. Brands will also need to factor in the continued return of international travel to pre-pandemic rates, which will be buoyed by a strong US dollar. Wholesale and physical retail have a new role in revamping customer journeys, requiring brands to look beyond tier-one cities to be physically closer to consumers.

Executives are bracing for a tough 2023; leading brands will deploy realistic but bold strategies that combine careful cost control with strategic investments in skills growth.

Brands will have to work hard to remain attractive to consumers, given the tough economic environment. Consumer behaviours in 2023 will depend greatly on household incomes. While higher-income households will be less affected by economic pressures and look likely to continue shopping for luxury goods, as in previous downturns, lower-income households will likely cut back or even eliminate discretionary spending, including apparel. Some will trade down, pivoting to value retailers, marked-down items and off-price channels while eschewing full price, premium and mass brands.

All this elevates the importance of brands’ marketing strategies. Brands should use the year ahead to innovate their digital marketing. Budgets will shift to alternative channels that could generate better return on investment than paid social media ads, such retail media networks, while building stronger brand communities. This will feed into distribution channels, as brands will need to seek higher margins and gather more first-party customer data.

How brands manage and communicate about issues that are important to consumers will also be critical. Consider sustainability. New and emerging regulations along with heightened consumer awareness of fashion’s contribution to the climate crisis mean that brands will need to be hyper-vigilant about how they talk about their sustainability-related initiatives and achievements to ensure they are not “greenwashing,” which could potentially lead to reputational damage or costly fines.

Further Reading